In-depth Market Research & Competitive Analysis

– Customer insights based on online data (forums, social media, search engines, self-help materials demand) to understand what people are searching for and talking about related to your problem space

– Industry trend analysis

– Both qualitative and quantitative analysis included

SWOT Analysis

– Strengths

– Weaknesses

– Opportunities

– Threads

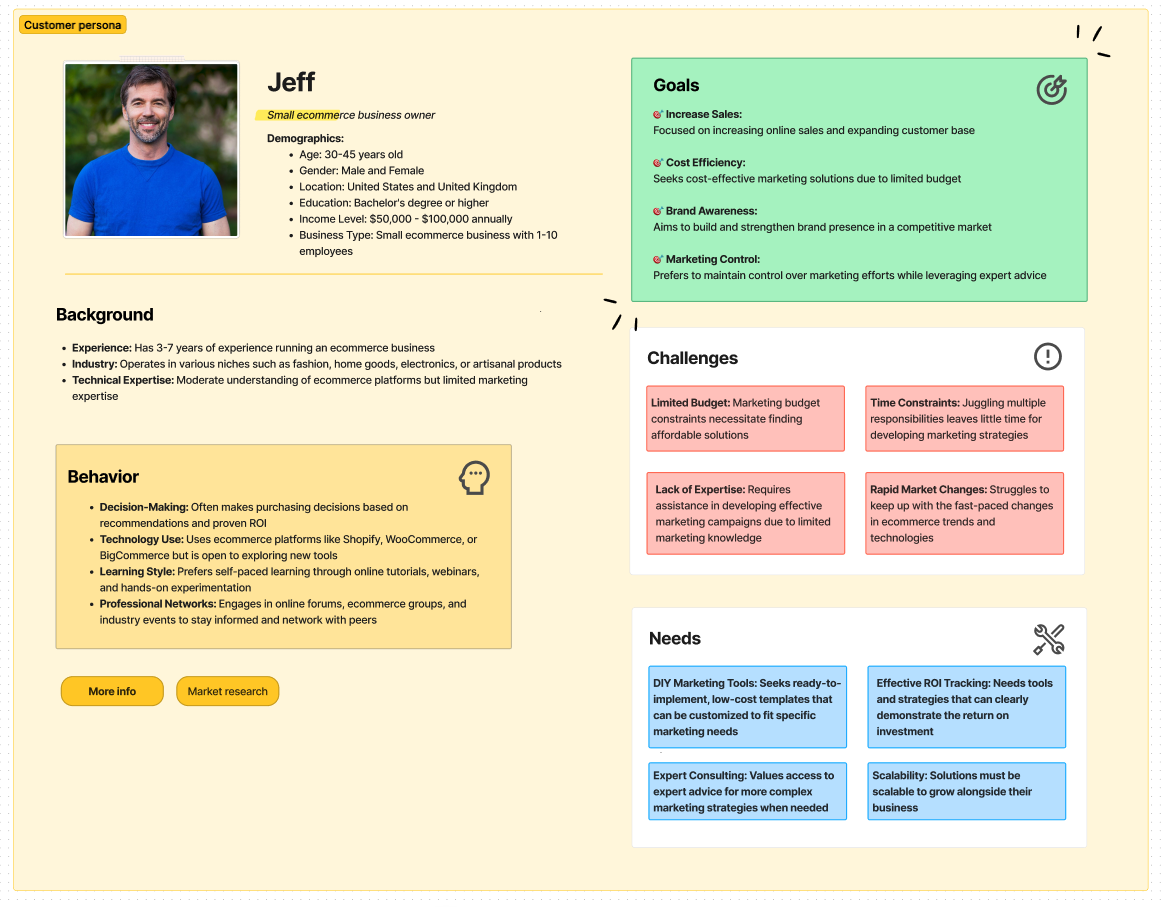

– Customer persona profile identification

– Demographics

– Psychographics & typical behaviors

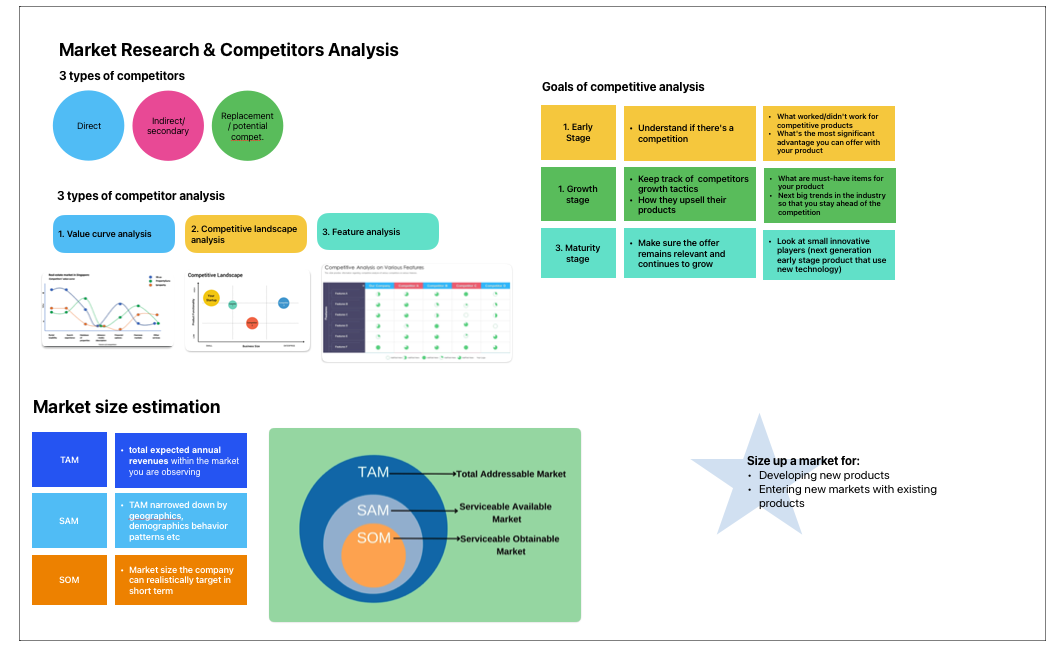

Market Size Estimation

– TAM (Total Addressable Market) – the whole market’s potential

– SAM (Serviceable Available Market) – TAM narrowed down by geographics, demographics, behavioral patterns, and other criteria; your longer-term target market

– SOM (Serviceable Obtainable Market) – the market size that a company is realistically targeting to capture in a short period; crucial for potential investors

Competitive Analysis

1. Early-stage product – assessing market competitiveness to gauge the importance of the problem and identify the most significant advantage for your product

2. Growth-stage product – defining must-have features and identifying emerging industry trends

3. Maturity-stage product – ensuring your product remains relevant and continues to grow while monitoring new competitors

– Direct Competitors – solve the same need for the same customers

– Secondary Competitors – address similar needs but in different ways, often for different users

– Replacement/Potential Competitors – offer a different product but compete for the same users

Competitive Landscape Analysis

Detailed analysis of three main competitors (direct or indirect, depending on the product):

Value Curve Analysis – compares key competitive factors in your industry to highlight your product’s strengths and areas for improvement

Feature Analysis – compares your product’s features against your closest competitors